MALAYSIA 2007 EXPANSIONARY BUDGET BOOSTS BUSINESS; Lower CORPORATE TAX; No EXAM FEES; HELP UNEMPLOYED GRADS; UP CIGARETTES & LIQUOR

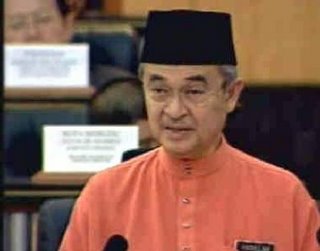

PM Abdullah delivering his 2007 Budget at 16.00 hr Malaysian Time

PM Abdullah delivering his 2007 Budget at 16.00 hr Malaysian Time(see 3 parts updates from STAR, Sep 03 06, bottom)

PM Unveils Budget To Boost Businesses And Ease Burden Of M'sians;

In other words, there was something for everyone in the government's action plan to spearhead the implementation of the National Mission towards realising the objectives of Vision 2020.

They include lowering the corporate tax by two percentage points on a staggered basis from the present 28 per cent to 27 per cent in year of assessment 2007 and 26 per cent in 2008, scrapping school examination fees and helping the 31,000 unemployed graduates in the country to find jobs.

Other perks include a bonus of between one and two months for government servants and higher housing loans for civil servants, more houses for the low-income group and increased funds to push development in the agriculture sector.

Some 146,000 civil servants living in government quarters also have much to cheer as they will also now enjoy the cost of living allowance (COLA) previously extended to those who do not live in such premises. But those living in quarters will get only half the COLA rate.

In tabling the 2007 budget at the Dewan Rakyat here Friday, Abdullah, who is also Finance Minister, outlined a host of measures to provide a more conducive environment to accelerate the growth of the private sector, which would resume its role to spearhead the country's economic development and move the economy up the value chain.

He also announced moves for more quality education and training at all levels and more scholarships for bright students to develop the country's human capital to realise the objectives of Vision 2020.

As expected by many, the government, in efforts to promote a healthy lifestyle, has raised the specific excise duty on cigarettes by one sen per stick while liquor with alcohol content of more than 40 percent will see the specific excise duty raised by RM5 per litre.

To encourage women to take mammogram tests, they will be given a subsidy of RM50 for every test done in private clinics and hospitals.

To help some 542,000 government pensioners deal with rising costs of living, the government will provide a one-off payment of RM400 to those currently receiving pensions of less than RM750 a month and RM200 for those receiving more than RM750 monthly.

To assist the disabled, Abdullah also announced an increase in sign language instructors and special education teachers for autistic children and raising the monthly allowance of some 9,000 disabled children to RM50 from RM25 currently.

To boost enrolment in national schools, the Chinese language will be a full subject in 150 national schools and Tamil in 70 national schools from next year.

Abdullah also said the government would build 30,000 houses under the people's housing project, Syarikat Perumahan Negara Bhd would build 34,000 affordable housing units, 2,000 under the plan to revive abandoned houses and 2,500 under the "Rumah Mesra Rakyat" programme.

Besides this, a sum of RM2.2 billion would be set aside to build 46,000 units of government quarters, such as the Royal Malaysian Police (PDRM), the Malaysian Armed Forces, Fire and Rescue Department and Royal Malaysian Customs Department and other civil servants.

New hospitals would also be built in Shah Alam, Pendang in Kedah and Permai in Johor with a allocation of RM125 million.

"The government will also improve the services of mobile clinics to generate awareness among the people in rural and remote areas on healthcare and nutrition, as well as provide free medical examinations, especially for early detection of chronic illnesses such as cancer, cardiac diseases, high blood pressure and diabetes," he said.

The prime minister said RM159.4 billion would be set aside to finance the budget from RM137 billion in Budget 2006 in efforts to soften the impact of slower global growth on the economy.

Of this, allocation for operating expenditure would increase 11.6 percent to RM112.9 billion while funds for development expenditure would increase 31 percent to RM46.5 billion.

Abdullah said the budget deficit would be reduced to 3.4 percent of Gross Domestic Product next year from 3.5 percent this year.

Private investment is expected to further expand by 10.5 percent while public investment would continue to be expansionary, with a growth of 8.0 per cent following significant increase in federal government development expenditure of 32.4 percent.

The manufacturing sector will continue to record strong growth of 6.8 percent, services sector including ICT, tourism and education, 6 percent, agriculture 4.7 per cent and construction 3.7 per cent.

To contain inflation, Abdullah said the government would incur RM19 billion this year in the form of oil subsidy and tax foregone, higher than the RM16 billion last year.

Based on the assumption that oil prices would hover at US$70 per barrel next year, the subsidy and tax foregone are expected to remain at the current levels.

Here, the prime minister stressed that the government would intensify enforcement efforts to ensure traders do not raise prices of essential goods "indiscriminately."

Of the proposed development expenditure, the largest allocation of RM20.8 billion is for the economic sector, comprising agriculture, industry and infrastructure.

Some RM14.2 billion is for the social sector, including education, health and housing while the vital security sector would be given RM6.8 billion, of which RM2.7 billion is for general administration and RM2 billion for contingency reserves.

To reduce business costs, venture capital companies investing at least 50 percent of their investment funds in seed capital would be given tax exemption for 10 years.

Also, to reduce the tax burden of the private sector, the zakat paid by cooperatives and trust bodies up to 2.5 per cent of their aggregate income would be given tax deduction.

Besides the RM20 billion of projects to be implemented under the private financing initiatives (PFI), he said the PFI Facilitation Fund of RM5 billion has been established.

Abdullah said RM3.6 billion would be given to develop the agriculture sector in efforts to transform it into a modern, commercial and competitive sector.

A substantial portion would be used to increase the Fund for Food by RM300 million to RM1.9 billion to finance food production, RM20 million to set up a non-food agriculture credit scheme to encourage farmers to venture into non-food agriculture such as floriculture and kenaf.

Abdullah said RM40 million had been set aside to implement the

Given that the planting of tobacco was no longer viable, especially in Kelantan, he said farmers would be given financing facilities by Bank Pertanian to grow other crops or venture into other industries to generate higher income.

To eradicate hardcore poverty, RM578 million will be allocated to speed up programmes and projects which will benefit some 110,000 participants while RM144 million would be given to further help the Orang Asli.

Abdullah also said RM90 million would be given to purchase and open up new plantation areas.

To boost rural development, RM3.4 billion has been allocated, of which RM780 million would be used to build rural roads, RM251 million for water supply and RM200 million for electricity supply while KEMAS will be given RM615 million to undertake pre-school education programmes, community activities and skills training.

In efforts to make

Local and foreign fund managers who manage Islamic funds for foreign investors will also be given tax exemption for 10 years while tax deductions will be given on expenses incurred in establishing an Islamic stockbroking firm.

The prime minister said the government had also proposed that dividends, received by local and foreign individual investors and local unit trusts from listed real estate investment trusts (REITS) be taxed at 15 per cent and foreign institutional investors at 20 per cent for five years.

To encourage banks to expand their operations overseas and set up a regional presence, the government has proposed that Malaysian banks be given tax exemption for five years on income received from their new branches or remittances from subsidiaries overseas, operating within the three year period.

Some RM210 million will be allocated under the 2007 budget to develop biotechnology as well as incentives for companies involved in the sector.

In unwavering efforts to promote the halal industry, the prime minister said RM50 million would be used to set up halal parks in Pasir Mas in Kelantan, Gambang in Pahang, Chendering in Terengganu and Padang Besar in Perlis.

"The SME Bank has also allocated RM20 million to finance entrepreneurs to develop these products," he said.

Civil Servants To Get Bonus;

Govt To Provide Investment-friendly Climate For Business To Flourish;

The public delivery system will be further improved and the cost of doing business will be brought down further, he said in the preface of the Ministry of Finance's 2006/2007 Economic Report released Friday.

"We will also vigorously enhance accountability, transparency and integrity as well as eliminate corruption and instil ethical values among Malaysians," he said.

Calling on the private sector to continue its role as the key driver of economic growth, the prime minister assured businessmen that they would continue to have opportunities to participate in the economy, with the most recent being the Private Finance Initiative (PFI).

Abdullah noted that since 2003,

"Economic growth is also supported by a healthy banking sector as well as an efficient capital market that provide the financing needs of the economy."

Abdullah, who is also Finance Minister, said the 2007 Budget would focus on the five thrusts of the National Mission 2006-2020 as mentioned in the Ninth Malaysia Plan.

"We will be focusing on these thrusts, which will help enhance the nation's competitiveness as well as ensure sustainable economic growth, social equity and high quality of life, delivered by a strengthened implementation capacity in the country."

The prime minister said global environment remained challenging in 2006 as a result of persistently high crude oil prices, inflationary pressures and monetary tightening, which had resulted in higher interest rates as well as the prospects of slower growth in the second half of the year.

But he stressed that the government was confident that the economy would register a healthy growth rate of 5.8 percent this year, given the nation's more diverse economic structure and strengthened domestic fundamentals.

Abdullah said that inflation remained at a manageable level although it had risen following higher energy costs and reduced fuel subsidies.

He also said

Deliberate measures had also been taken to make the Malaysian economy more diversified and broadbased to ensure sustainable growth.

Continuous efforts had been pursued to enhance the services sector, accelerate value added of the manufacturing sector and boost the agriculture and agro-based sector as the third engine of growth.

New sources of growth continue to be promoted and developed such as biotechnology, information and communications technology, halal products and Islamic finance.

Govt Proposes Tax Relief Of Up To RM3,000 For Purchase Of Computer ;

The relief will be given once in three years instead of once in five years.

Currently, taxpayers are eligible for a tax rebate of RM500 for the purchase of a computer and the rebate is given once in five years per household.

In the case of separate assessment, each taxpayer is eligible to claim the relief (instead of on a per household basis).

In the case of combined assessment, such expense is deemed incurred by the spouse who pays income tax.

The proposal is effective from year of assessment 2007.

Police Get RM4.9 Bln To Enhance Public Security;

Prime Minister Datuk Seri Abdullah Ahmad Badawi said the allocation would enhance police operations and also enable the police to implement the Command, Control, Communication and Computerisation for Information Programme to install closed-circuit televisions (CCTVs) in crime-prone areas.

An additional 2,000 police patrol cars would be deployed to ensure public security and increase public confidence, Abdullah, who is also the Finance Minister, said when tabling the 2007 Budget in Parliament Friday.

Abdullah said the number of posts of police drivers would be increased by 3,000 while the existing allowance for motorcycle spare parts for patrolling policemen would also be increased, from RM80 to RM120.

In addition, Abdullah said, a sum of RM2.2 billion was allocated to build 46,000 units of government quarters for personnel of uniformed services, such as the police, the military, Fire and Rescue Department, Royal Malaysian Customs and other civil servants.

&&&&&&&&&&&&&&&&&&&&

Govt Will Continue To Address Socio-economic Disparities ;

This will be carried out through programmes to eradicate poverty, generate balance development especially in less-developed regions as well as to ensure that the benefits of growth and development are more equitably distributed.

According to the 2006/2007 Economic Report released by the Treasury today, the government's commitment to improving the quality of life was evident in the target to eradicate hardcore poverty by 2010.

"Intensified efforts have been made to enhance the earning capacity of the rural poor," it said.

Although the incidence of poverty was reduced from 22.8 per cent in 1990 to 5.7 per cent in 2004, there were still 67,300 households who remained as hardcore poor, with 14,100 of them in urban areas.

The report said the government remained committed to ensuring public utilities were made more accessible including to extend rural electricity coverage and upgrade water supply facilities in rural areas.

As at end-June this year, a total of 6,642 additional households benefitted from the rural electrification programme and 32,216 households particularly in

"In addition, efforts in bridging the knowledge and digital divide between the urban and rural areas are also ongoing and to date, 42 rural internet centres have been established by the Ministry of Energy, Water and Communications to provide ICT-based opportunities to rural communities," it said.

The report said that currently, 58 community communications development centres had been initiated and funded by the Malaysian Communications and Multimedia Commission (MCMC) to increase community access to network services and facilities.

Meanwhile, 30

At the same time, more programmes and projects will be channelled to provide assistance to the orang asli community and disadvantaged groups, such as the disabled, the elderly and single mothers to ensure that they are not left out of the mainstream of national development.

According to the 2006/2007 Economic Report released by the Treasury today, to achieve the growth, productivity and competitiveness across all sectors of the economy might be enhanced.

"From the human capital perspective, there is a need to raise capacity for knowledge in innovation as well as nurture a productivity mindset," the report said.

The 9MP has reiterated the importance of shifting towards productivity driven growth to move the economy on a faster growth track.

TFP is a measure of the efficiency with which an economy's productive inputs and technology are used in the production process. TFP improvement is realised through increasing output without a corresponding increase in the quantity of inputs, achieved by efficient and effective utilisation of both labour and capital.

According to the report, the adoption and application of new technology was crucial for value creation and rationalising cost.

Industries must continuously seek more creative and innovative ways to remain competitive through operational efficiency and effectiveness.

"The government will continue to improve the public sector delivery system, so as to facilitate an environment conducive for doing business," the report said.

It said, the thrusts of human capital development for 9MP included undertaking comprehensive improvement of the education and training delivery systems, strengthening national schools, to bridge the performance gap between rural and urban schools, creating universities of international standing, nurturing an innovative and creative society and strengthening national unity.

The thrusts are supported by several fiscal incentives like automatic child relief for each child studying in higher learning institution, relief for disabled child pursuing tertiary education and individual tax relief of RM5,000 for pursuing further education in professional courses.

&&&&&&&&&&&&&&&&&&&&&&&&&

"Efforts are underway to reduce the dependence on foreign workers by encouraging greater automation and mechanisation of labour intensive industries," it said.

It is envisaged that by that time, only 250,000 foreign workers will remains in the manufacturing sector and another 200,000 in the construction sector.

To reduce the dependency of foreign workers in the construction, manufacturing and services sectors, the government has made it mandatory for all employers to advertise their vacancies through the Electronic Labour Exchange (ELX) at the Manpower Department, to create greater awareness of existing job opportunities.

"Employers in the three main sectors are required to advertise vacancies for a duration of one week for the plantation sector, two weeks for services and a month for the manufacturing sector to provide ample opportunities for Malaysians to take up the vacancies, failing which foreign workers may be considered," it said.

As part of ongoing efforts to encourage local workers in the hospitality industry, especially in hotels, restaurants and other business services outlets, the government has allocated RM30 million under the Ninth Malaysia Plan (9MP) to Pembangunan Sumber Manusia Berhad (PSMB) to train 5,000 Malaysians annually to meet industry needs.

"This programme is expected to, among others, offer more apprentice training schemes designed to focus on developing multi-tasking skills in the hospitality industry," it said.

At the same time, the government is actively promoting the 'Brain Gain' programme to encourage qualified Malaysians working abroad to return home.

As of June 2006, there were 1,84 million registered foreign workers of which 33.3 per cent were employed in manufacturing, plantation (20.2 per cent), services (including domestic maids) (25.9 per cent) and construction sector (15.1 per cent).

The majority of foreign workers were from

Apart from that, the report said, the labour market conditions were expected to remain favourable in 2006, especially in the second half with rising employment opportunities with total employment expected to reach 11.1 million compared to 10.9 million last year.

The unemployment rate is projected to remain low at 3.5 per cent, maintaining full employment for 15 consecutive years, it said.

On the labour force participation rate, both male and female participation rate is expected increase which will indicate the overall rate to remain high at 66.9 per cent this year.

"Although the overall female participation rate is still low compared with advanced countries, participation of women with tertiary education has been on the uptrend in recent years," it said.

It is projected that the proportion of the overall labour force with tertiary education to increase to 21.1 per cent in 2006 (20 per cent in 2005) in line with the government's concerted efforts at enhancing the quality of human capital in the country.

Updated: Sunday Sep 03 06

But instead of a salary increase, the government was helping them by giving facilities that could reduce their spending, like reducing their school expenses, he said when opening Gerakan's 35th National Delegates Conference here Saturday.

Among the goodies announced in the 2007 Budget were the abolition of UPSR, PMR, SPM and STPM examination fees, giving of scholarships to outstanding SPM students, increase in tax relief for the purchase of books and tax relief of RM3,000 for the purchase of computers in place of a tax rebate of RM500.

Abdullah said the incentives and reliefs in the 2007 Budget were for the benefit of all the people irrespective or race or religion. He said the budget also stressed important aspects concerning human capital development among the young generation.

"Our children in school must be raised and given the best education without any constraint, either financially or in terms of facilities."As such, it is the government's duty and responsibility to continue to raise the quality of teaching and learning of our children," he said.

Abdullah said the young were a very important asset to the nation and should be raised in an atmosphere of peace and security.

Budget 2007 under the microscope

THIS is the first of a three-part question-and-answer series provided by PricewaterhouseCoopers for The Star readers on various aspects of Budget 2007.

THE PWC TEAM: Front row (from left): managing consultant Lorraine Yeoh and senior executive director Margaret Lee. Back row (from left): Consultant Nora Aida Sulaiman, managing consultant Suzana Kavita and senior consultants Anushia Joan Soosaipillai and Jason Lim. Why is there no proposed reduction in personal tax rates in line with the proposed reduction in corporate tax rate from 28% to 26%? The proposed reduction in corporate tax rate over a two-year period will result in a significant decrease in revenue for the Government. We hope that with the implementation of the Goods and Services Tax (GST) at a later date, the personal tax rates will be reduced and aligned with the proposed corporate tax rate of 26%. Next year is Visit Currently, income tax exemptions are given to: i) leave passages provided by an employer to an employee for expenses on fares only for travel within Malaysia not exceeding three times in any calendar year; or ii) one leave passage for travel between To further encourage domestic tourism, the Government has proposed that income tax exemption on local leave passage be extended to include expenses on meals and accommodation. It was announced during Budget 2007 that the Inland Revenue Board (IRB) would issue advance tax rulings to ensure certainty of tax treatment and transparency in tax administration. Do you know the procedures for the application for such an advance tax ruling? Is the advance tax ruling binding on the applicant taxpayer and for how long? Can the applicant taxpayer appeal against the advance tax ruling if he disagrees with the IRB’s prescribed tax treatment under the advance tax ruling? Under the proposed advance ruling system, which is effective i) the arrangement is materially different from the arrangement stated in the ruling; ii) there was a material omission or misrepresentation in, or in connection with the application of the ruling; iii) the IRB makes an assumption about a future event or another matter that is material to the ruling, and that assumption subsequently proves to be incorrect; or iv) the applicant taxpayer fails to satisfy any of the conditions stipulated by the IRB. We believe there may be some procedures in place in due course for the applicant taxpayer to further discuss or appeal against the IRB’s prescribed tax treatment under the advance tax ruling in the event of any disagreement. Both my husband’s and my income are assessed separately. My husband is taxed at the marginal income tax rate of 13% while I am being taxed at the marginal income tax rate of 28%. We are considering buying a new computer for the house worth RM3,000 and would like to understand the impact of the proposed budget changes. Before the proposed changes take effect, a tax rebate amounting to RM500 was granted to either the husband or wife. Therefore, it would have had a similar tax impact whoever claims it. However, based on the proposed budget changes, it would be more tax advantageous if you purchase and claim the expense as a relief in your tax return as it will result in tax savings at 28% (RM3,000 at 28% = RM840) versus 13% (RM3,000 at 13% = RM390) for your husband. As a tour operator, I have vehicles, which are being used as part of my tour business but not for hire. Would I qualify for the 50% excise duty exemption if I decide to purchase locally assembled four-wheel drive vehicles? The Budget 2007 proposal does not specify how four-wheel drive vehicles must be used by a tour operator in order to qualify for the exemption. Currently, as a matter of policy, only car rental operators for tourists are granted excise duty exemption on the purchase of national cars. It is therefore necessary to seek clarification on the scope of the exemption. I understand that there is a proposed enhancement to the incentive for the venture capital industry. Kindly explain. Yes, this incentive was one of the many incentives proposed by the Government with a view to improving existing incentives and reducing the cost of doing business. For the venture capital industry, the proposal is aimed at increasing funding in seed capital. Venture capital companies investing at least 50% (as opposed to the present 70%) of its investment funds in venture companies in the form of seed capital is given income tax exemption for 10 years.