Genting Berhad is an investment holding and management company. Through its subsidiaries, the Company operates through six divisions. The Leisure & Hospitality division includes the Company's hotel, gaming and entertainment businesses, tours and travel related services and other support services. Its leisure and entertainment businesses range from land-based resorts to cruising on seas. The Plantation division is engaged in oil palm plantations, palm oil milling and related activities. The Property division is involved in property development activities. The Manufacturing division is engaged in the manufacturing and trading of paper and paper-related products, and downstream activities involving packaging. The Oil & Gas division is engaged in oil and gas exploration, and sale of crude oil. The Power division is engaged in engaged in the generation and supply of electric power, and operates a 720-megawatt Kuala Langat power plant in Malaysia. The Company operates in Asia Pacific region.

Win set to boost Genting shares as company goes global;

Win set to boost Genting shares as company goes global; from

business-times.asiaone.com By S JAYASANKARAN IN KUALA LUMPUR; Published December 9, 2006

BY WINNING the right to develop the Sentosa integrated resort project, Malaysia's Genting Bhd group is poised to be re-rated as a global gaming company with operations in Malaysia, London and Singapore. ________________________________________

Mr Lim: Investors favour the new and brasher direction that the Genting chairman is taking

_______________________________________

More immediately, however, its triumph is expected to add considerable fizz to its share price. 'Although this (Genting's victory) was widely expected, it's still fantastic from a market perspective,' said Jason Chong, a fund manager with UOB-OSK Asset anagement in Kuala Lumpur. 'I've seen brokers' reports which, including Sentosa, value Genting at between RM33-36 a share.' Genting closed at RM29.25 in Kuala Lumpur yesterday.

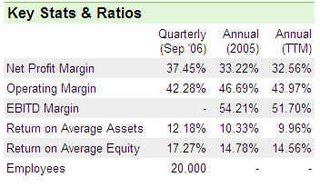

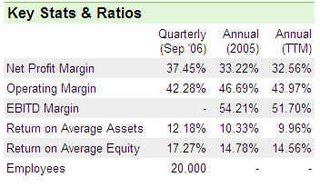

Genting's victory signals a new and brasher direction under its chairman Lim Kok Thay. Mr Lim, the son of Genting's patriarch and founder Lim Goh Tong, has eschewed the conservative, risk-averse ways of his father and stamped his mark on the group since taking over the reins in 2002. The company has diversified into oil and gas, power and packaging, besides aggressively extending its gaming reach by investing in London - and now Singapore. Investors like it. Genting's share price hit a historic high of RM30 recently, a fact company officials downplay by pointing out that the previous high was achieved during the mid-1990s - at a time when profits were half of those being achieved now. Its 2005 net profit was RM1.25 billion (S$545 million). Indeed, company officials reckon investors don't give Genting the valuations it deserves. Global gaming companies routinely trade at 33-35 times earnings, while Genting is trading at 14 times 2007 earnings.

But the Sentosa project will transform Genting into the world's third-largest gaming company, which could make it a must-have stock for fund managers in future. On the other hand, the win on Sentosa could have negative consequences for Genting's flagship resort-casino atop the Genting Highlands east of Kuala Lumpur, although these would only kick in after 2009 when the Sentosa project is completed. 'It could affect visitor arrivals to the highlands by as much as 20 per cent because of curiosity about the new kid on the block,' said James Lau, chief executive officer of Southern Bank Securities. 'But it will be a temporary thing because, don't forget that the great pull about the highlands is its (low) temperature.'

The Singapore project is expected to cost $5.2 billion, but Genting, with its healthy balance sheet and net gearing of only 10 per cent, isn't likely to find funding a problem. Indeed, analysts think that the project is a money spinner with an internal rate of return of 15-20 per cent, which indicates a payback period of five to seven years. Moody's Investors Service yesterday affirmed the ratings of Genting and its associate Star Cruises, which will have a 25 per cent stake in the Sentosa IR project. The other 75 per cent is held by Singapore-listed Genting International, a subsidiary of Genting Bhd. Moody's affirmed the A3 issuer and debt ratings of Genting Bhd with a stable outlook. And it maintained Star Cruises' B1 corporate family rating with a negative outlook due to its high borrowings. 'While this large-scale greenfield project, with an estimated cost of over $5 billion, will increase Genting's exposure to development and execution risks, as well as capital needs in the medium term, it will also strategically strengthen the company's regional coverage and competitive position over the long term,' said Moody's lead analyst Kaven Tsang.

= = = = = = = == = = = =

Genting comes up trumps, from business-times.asiaone.com

Its proposal reflects vision of Sentosa IR as world-class resort with strong

family emphasis: Jayakumar By DANIEL BUENAS AND UMA SHANKARI

Published December 9, 2006

(SINGAPORE) Genting International has come up trumps in the bidding for Singapore's second integrated resort, seeing off rivals Kerzner International and Eighth Wonder in the contest for the multi-billion-dollar prize. Announcing the winner yesterday, Deputy Prime Minister S Jayakumar said Genting International - partnered by Star Cruises - submitted the 'most compelling proposal overall' that best met Singapore's economic and tourism objectives. 'In particular, the proposal reflects our vision for the Sentosa IR as a large-scale, family resort with its host of world-class family leisure attractions and other strong offerings,' he said. 'We believe that the attractions will position Sentosa as a premier island resort for families and draw significant numbers of both new and repeat visitors to Singapore.'

Prof Jayakumar headed the high-level Tender Approving Authority (TAA) that helped decide the IR winner. Singapore Tourism Board (STB) chief executive and deputy chairman Lim Neo Chian revealed yesterday that a survey of about 5,000 people from Singapore's key tourist markets - commissioned by STB and conducted by US-based consultants - found that tourists from these markets were most interested in branded theme parks, followed by water-based parks and educational attractions.

'They (Genting International) were square on with their product that they were proposing,' said Darrell Metzger, chief executive of Sentosa Leisure Group. Genting's development - due to be launched by early 2010 - is also likely to draw a large number of local visitors, he said. Trade and Industry Minister Lim Hng Kiang, also part of the TAA, said Genting's project - Resorts World at Sentosa - will generate an estimated $2.7 billion of value-add - about 0.8 per cent of Singapore's GDP - and 30,000 jobs in 2015.This is similar to the value-add the Marina Bay IR is expected to generate. The Marina and Sentosa resorts will complement each other and allow Singapore to grow both its meetings and conventions business as well as leisure tourism, the judges said.

Mr Lim also highlighted some of the key factors that led to the decision to pick the Genting consortium, which had been tipped by many analysts and market watchers as the front-runner for the Sentosa IR. He said Genting's tie-up with Universal Studios included a 30-year exclusive franchise for South-east Asia, and pointed out that 16 of the 22 major attractions planned for the park will be specially designed for Singapore. During yesterday's news conference to announce the IR winner, Prof Jayakumar also responded to a query on whether Singapore-Malaysia political ties affected the outcome. He said bilateral relations with the countries of the bidders were 'not a factor', but added: 'Now that Genting has been successful in this bid, we look forward to working with them to develop a world class IR and I'm sure this will bolster the strong economic ties between the two countries.'

In a report issued shortly after the announcement of the winner, investment bank Merrill Lynch - which gave Genting a 75 per cent chance of victory - said the win was a 'transforming deal' for Genting International. 'This project gives the company a major new engine for growth, an expanded portfolio of assets and enhanced credibility globally which should facilitate further success in future bids,' the report said. Merrill Lynch, which has a 'buy' call on Genting, upgraded its price target for the stock to 50 cents from 42 cents. A value of seven cents a share was given for winning the Sentosa project. Genting's shares have enjoyed a good run on the Singapore Exchange lately, hitting a one-year high of 44 cents on Tuesday. The stock closed at 41.5 cents yesterday. 'The government made a choice that will solidify Singapore's leisure sector tourism base and will likely grow it significantly in the future,' said Jonathan Galaviz, a partner at Las Vegas-based leisure sector consultancy Globalysis. 'Genting's operational experience in Asia combined with significant intellectual properties such as Universal Studios and Dreamworks (headed by

renowned film director Steven Spielberg) will make the Sentosa IR a very compelling global tourist attraction.' Responding to the win, an ecstatic Genting International said it was 'wonderful news'. 'In three years, visitors will experience first-hand Resorts World at

Sentosa, the global tourism icon that we envision it to be,' said Lim Kok Thay, chairman of Genting International and Star Cruises. 'It will change the face of tourism in the region. We are confident that by 2010, Resorts World at Sentosa will attract 15 million visitors.' Genting spokesman and head of strategic investments and corporate affairs Justin Leong said: 'We thank the governments of both Malaysia and Singapore for their support and confidence in us. We hope this marks a new era for Malaysian-Singaporean ties.'

In a statement, the Kerzner International-CapitaLand consortium - which some observers viewed as a favourite - said it was 'disappointed' to learn of the government's decision. But it congratulated Genting and offered 'the government and people of Singapore our best wishes for success'. Similarly, dark horse Eighth Wonder thanked the government for the opportunity to bid for 'one of the most exciting development projects in history'. Eighth Wonder chairman and chief executive Mark Advent, however, indicated that the consortium and its partners are keen on other opportunities in the region. 'Looking ahead, we have every intention of building on the relationships we have established,' he said in a statement. 'We are looking forward to embracing South-east Asia with another world-class opportunity.'= =

= = = = == = == = = = =

Genting "ecstatic" over winning bid for Sentosa IR

from asia.news.yahoo.com/----------------------------------------------------------

Genting wins casino licence; Saturday December 9, 2006; By YEOW POOI LING

SINGAPORE: Genting International-Star Cruises Consortium has won the Singapore government’s approval for the proposed Resorts World at Sentosa, a casino resort which will be home to the region’s first Universal Studios theme park. The park will also include DreamWorks Digital Animation Studios. “We are extremely delighted to have been chosen and are very excited and honoured to be entrusted with the great task of taking Singapore’s tourism sector to the next level,” said Genting International plc and Star Cruises chairman Tan Sri Lim Kok Thay in a statement yesterday.

The Genting group beat two other contenders – Bahamas-based Kerzner International, which teamed up with Singapore property developer CapitaLand, and Las Vegas firm Eighth Wonder, which led the consortium of Australia’s Publishing and Broadcasting Ltd, Hong Kong’s Melco International Development Ltd and Isle of Capri Casinos Inc.

Resorts World at Sentosa, which will be launched by early 2010 and dubbed Asia’s most “mesmerising” family resort, will welcome families with a dazzling array of leisure, entertainment, learning and discovery experiences, the statement said. The world’s largest oceanarium, Quest Marine Life Park, will provide visitors with interactive experiences to learn about, and discover, the life of marine creatures and the need for ocean conservation, while Equarius Water Park will incorporate the latest water theme park technology, nestled under Sentosa’s forest.

The Maritime Xperiential Museum, the only museum in the world dedicated to the maritime heritage of Asia, will engage visitors’ five senses to re-tell the fascinating history of the Asian maritime Silk Route. It will also feature Asia’s first marine genomics research and learning centre, which will be set up by Dr. J. Craig Venter, a pioneer and leading expert in the field. The resort will offer six world-class hotels with a combined 1,830 rooms as well as house the region’s first fully integrated wellness spa, which will be operated by luxury spa operator ESPA, the Genting statement added.

= = = = = == = == = = == = =

GENTING GROUP WINS SINGAPORE SENTOSA INTEGRATED

RESORT PROJECT UPDATE3 08-Dec-2006 19:24:00, from ZOOM Finance

(adds Genting's comments) -

SINGAPORE (XFN-ASIA) - The government has chosen Genting International and its partner Star Cruises to develop an integrated resort with a casino on Sentosa Island, deputy prime minister S Jayakumar said. The Genting group beat two other bidders, including the consortium of CapitaLand and Kerzner International and US-based Eighth Wonder. "All three bidders submitted high quality proposals," Jayakumar said. Jayakumar said improving relations between Malaysia and Singapore is not a factor in Singapore's decision to pick Genting for the Sentosa integrated resort (IR).

"Now that Genting has been successful... this will bolster the strong economic ties between the two countries," Jayakumar said. The Sentosa integrated resort project is the second such project Singapore is developing. In May, the government awarded the first such project on Marina Bay to Las Vegas Sands. Genting group is spending about 5.2 bln sgd to develop the Sentosa IR, while Las Vegas Sands is spending over 3.2 bln usd on the Marina Bay IR. While the main focus of the Marina Bay IR are business travellers attending conventions at its huge exhibition hall that can accommodate 52,000 people, the Sentosa IR is focused on tourist attractions, with Genting planning to build a 1.0 bln usd Universal Studios theme park. The economic contribution of Sentosa IR will be similar to Marina Bay IR, with each of the project expected to boost Singapore's GDP by 0.80 pct or about 2.7 bln sgd annually, Trade and Industry minister Lim Hng Kiang said.

Lim said the Sentosa IR, which is expected to be completed in 2010, would create some 30,000 jobs by 2015. "Both the Marina Bay and Sentosa IRs complement each other and will enable us to catalyze the growth in our two largest visitor segments of BTMICE (business travellers, meetings, incentives, conventions and exhibitions) and leisure," Lim said. According to analysts, the Universal Studios theme park proposal gave Genting an edge over bidders. Six out of seven analysts polled by XFN-Asia last week predicted Genting will win. "Genting, with its Universal Studios theme park component offers a clearly branded tourism strategy," said Merrill Lynch analyst Sean Monaghan.

Genting chairman Lim Kok Thay said he is confident that their Sentosa IR, to be called Resorts World at Sentosa, will contribute positively to Singapore. "It will change the face of tourism in the region. Resorts World at Sentosa will attract 15 mln visitors," he said.

UOB KayHian economist Leslie Tang said the IR projects will be "quite positive for the economy." "It will generate employment, since each of the casino bidders have already said they will try to employ as many locals as possible," Tang said.

Indirectly, the property sector will also benefit from the projects, Tang said, noting that prices of residential projects being built on Sentosa had been rising. The construction sector, which has been in the doldrums for years will be another beneficiary. "Construction will definitely be a boom and retail sales will probably see a boost from more tourist arrivals," he added. "The IR will definitely help us meet our 17 mln tourist target (by 2015)," Tang said.

= = = = = == = = == == = = == = = ==

Genting Looks Forward To Developing Resort World Sentosa

December 08, 2006 22:04 PM

KUALA LUMPUR, Dec 8 (Bernama) -- The Genting International-Star Cruises consortium, which won the bid to build Singapore's second casino resort Friday, is looking forward to contributing to Singapore's tourism industry. "We are extremely delighted to have been chosen and are very excited and honoured to be entrusted with the task of taking Singapore's tourism sector to the next level," said its chairman Tan Sri Lim Kok Thay. Resorts World at Sentosa, which is to be launched by early 2010, will be equipped with multiple world-class attractions offering the best in entertainment, edutainment and enrichment for both young and old. Meanwhile, Moody's Investors Services has affirmed the A3 issuer and debt ratings of Genting Bhd with a stable outlook. At the same time, Moody's has affirmed the B1 corporate family rating ofStar Cruises Ltd. The rating outlook remained negative. Genting is engaged in the leisure and hospitality, power, plantation, paper and packaging businesses, as well as oil and gas exploration activities.

continue read:

PROTEST in MONGOLIA Against Murder Of ALTANTUYA SHAARIIBUU; CALL On MALAYSIAN Government to APOLOGIZE & Support HER 2 CHILDREN Until Majority Plus Medical Expenses

Win set to boost Genting shares as company goes global; from business-times.asiaone.com

Win set to boost Genting shares as company goes global; from business-times.asiaone.com

0 Comments:

Post a Comment

<< Home